How to Safely and Quickly Make Cryptocurrency Transactions and Payments

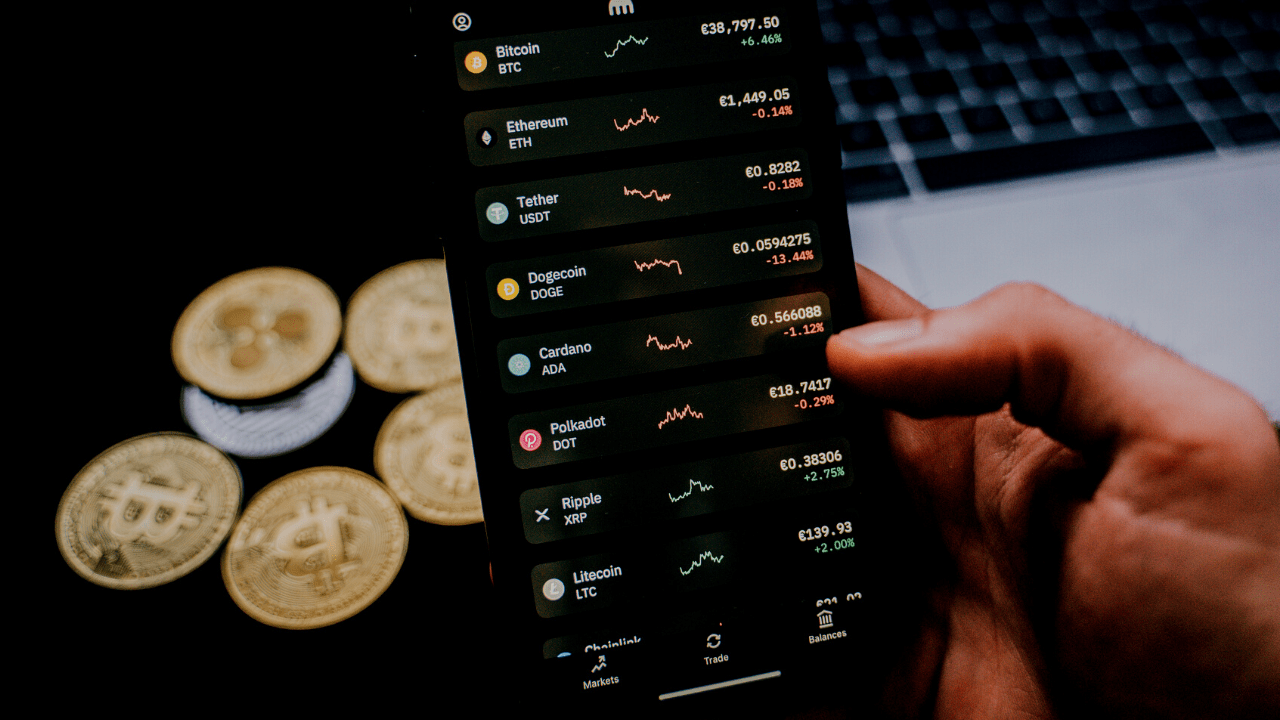

In the modern world of finance, transaction and payment systems play a key role in ensuring fast, secure, and convenient transfer of funds between participants. With the development of technology, many methods of making payments have appeared, significantly expanding opportunities for both individuals and businesses. In this article, we will explore the main types of transactions, modern payment systems, their features, and operating principles. Financial transactions can be classified based on various criteria, depending on the source of funds, the method of execution, or the participants involved. The main types include: Payment systems are infrastructure that ensures the secure and fast transfer of funds. They are divided into several categories depending on their operation method and technologies: The most common are systems implemented by banks, such as Visa, MasterCard, the Asia-Pacific Payment System, and national systems like MIR in Russia. They use cards to pay for goods and services, as well as for cash withdrawals at ATMs. Transactions go through processing centers that verify and confirm operations. Electronic wallets allow users to store money digitally and make payments without using a plastic card. Popular solutions include Apple Pay, Google Pay, Samsung Pay, Yandex.Money, Qiwi, WebMoney. These systems are integrated with mobile devices, making payment as convenient and quick as possible. In most cases, to make a payment, it is enough to bring the smartphone to a terminal or select the appropriate option in the app. Platforms like PayPal, Stripe, Skrill, as well as built-in internet banking systems, are used for online shopping and transfers. They enable secure transactions over the internet with minimal time and effort. An important feature of these systems is built-in data protection and the ability to refund in case of fraud or errors. Security of payment operations is a top priority for modern systems. Various methods and technologies are used to protect data and prevent fraud: Transaction systems are based on several key principles that ensure their reliability and efficiency: With technological advancements, further simplification and acceleration of transactions are expected. The introduction of blockchain technology and cryptocurrencies opens new possibilities for decentralized payment systems with high security and transparency. Additionally, cashless technologies such as NFC and biometric payments are actively developing, making payments even more convenient. Artificial intelligence and data analytics provide new tools for fraud prevention and improving transaction processing efficiency. Transactions and payment systems are an integral part of the modern economy. Their development ensures not only the security and speed of operations but also convenience for users worldwide. The constant implementation of new technologies, security standards, and innovative solutions makes financial operations more accessible and reliable, meeting the demands of the times and the needs of modern society.

Overview of Transactions and Payment Systems

Types of Financial Transactions

Modern Payment Systems

Traditional banking systems

Electronic wallets and mobile payments

Internet payment systems and online banking

Security Technologies for Transactions

Principles of Transaction System Operation

Future of Transactions and Payment Systems

Conclusion

Published:

Views: 191